What is VAT settlement?

Last updated 26/08/2025 – Reading time: 2 min

VAT invoicing is the process by which a VAT-registered company reports and pays VAT to the Danish Tax Agency. Depending on the size of the company and industry, VAT must be paid monthly, quarterly or semi-annually.

When you run a business, paying VAT correctly is crucial to avoid penalties and interest. It’s all about reporting on time and making sure your income and expenses are correct.

If you are unsure if your business is registered for VAT, you can check here.

How VAT invoicing works

- Calculate your company's total sales VAT (VAT collected from customers).

- Calculate your company's total purchase VAT (VAT paid on purchases).

- Subtract purchase VAT from sales VAT to find the amount to be paid in or paid out.

- Report the figures to the Tax Agency via TastSelv Erhverv.

Deadlines for VAT invoicing

There are three settlement periods for VAT, with the deadline depending on your turnover:

- Monthly VAT: typical for large businesses.

- Quarterly VAT: for most small and medium-sized businesses.

- Half-yearly VAT: for smaller businesses with lower turnover.

For example, quarterly VAT must be reported four times a year, while half-yearly VAT is only reported twice.

It’s important to keep track of deadlines to avoid interest or fines.

Quarterly VAT

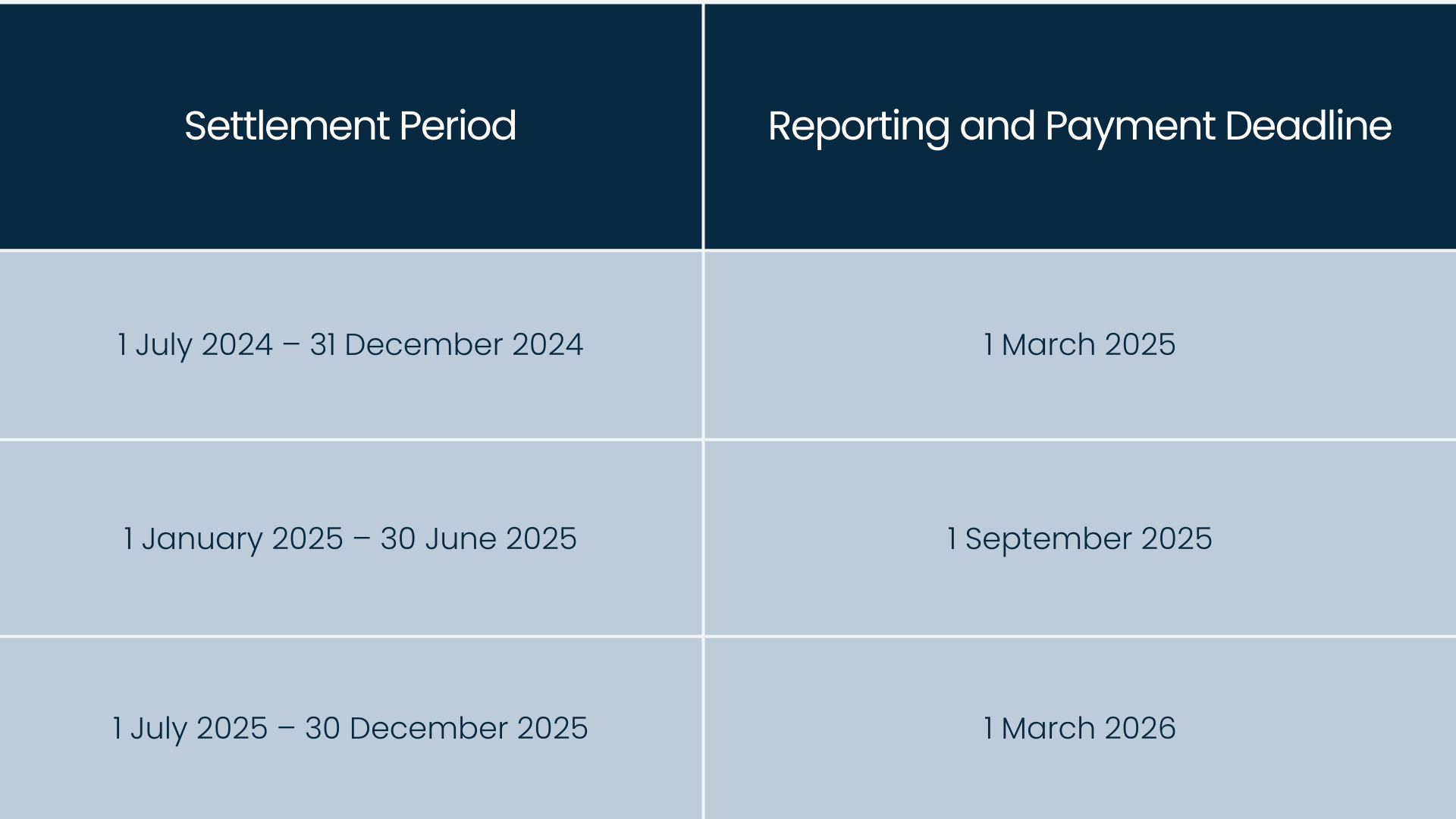

Quarterly VAT applies to most small and medium-sized businesses. You need to report four times a year, see the exact deadlines in the table below.

Half-yearly VAT

Half-yearly VAT is used by smaller businesses with lower turnover. Here you only need to report twice a year, typically in March and September.

Consequences of late VAT payments

If VAT is not reported on time, the company may receive a fine of DKK 800. In case of repeated delays, the Danish Tax Agency will automatically calculate interest on the amount owed. Correct and timely VAT reporting ensures that your business avoids unnecessary extra costs.

Relevant legislation

All official deadlines and rules for VAT settlement can be found on the Tax Agency’s website. Here you can also read about special conditions if your business sells abroad or has VAT-free services.

Frequently asked questions about VAT invoicing

Many businesses are unsure how to handle VAT invoicing correctly, especially when there are changes in turnover or business type.

At Accountview, we help you get a handle on deadlines, rates and accounting so that everything is reported correctly and on time.

If you need help or guidance, you are always welcome to contact us directly here.