B-tax - what is it and how does it work?

Last updated 26/08/2025 – Reading time: 2 min

If you run a personally operated business (sole trader, partnership or freelance) you don’t directly receive a salary or pay corporation taxbut you must dHowever, you do have to pay tax on the profits of the company. The tax is paid in 10 installments each year and payment is made on the 20th of each month except for June and December.

How is B-tax calculated?

The tax is determined based on the expected profit that you enter in your tax return. By making regular payments, you avoid large tax arrears and interest that is not deductible. It also gives you a better financial overview of your business.

The benefits of paying B-tax regularly:

- You avoid a large tax bill.

- You avoid interest that is not tax deductible.

- You get a better overview of your business finances.

If you need help adjusting your withholding tax return or understanding the rules for paying B tax on profits, we can guide you in the right direction.

If you want to read the official rules, you can find more information on the Tax Agency’s website here.

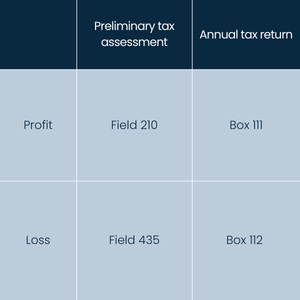

Prepayment statement vs. annual statement

- Prepayments are the current year and an estimate of the expected result.

- The annual report is published the following year in March and is a look back at the actual result.

Example of calculation

If your company expects a profit of DKK 200,000 and the tax rate is 38%, you must pay DKK 76,000 spread over the year. If you don’t pay regularly, you risk a large tax arrears and interest that can amount to thousands of dollars.

Want to avoid back taxes and interest?

At Accountview, we can help you to:

- Adjust your withholding tax return.

- Get a handle on tax and payments.

- Optimize your tax situation.

If you have more questions or are in doubt about any of the above, you can contact us here for an informal chat.