Deadlines for annual report and tax return

Last updated 26/08/2025 – Reading time: 2 min

If you run a company, it’s important to know the deadline for submitting your annual report and tax return. Companies must submit the annual report to the Danish Business Authority and the tax return to the Tax Agency within certain deadlines, and these vary depending on your financial year-end.

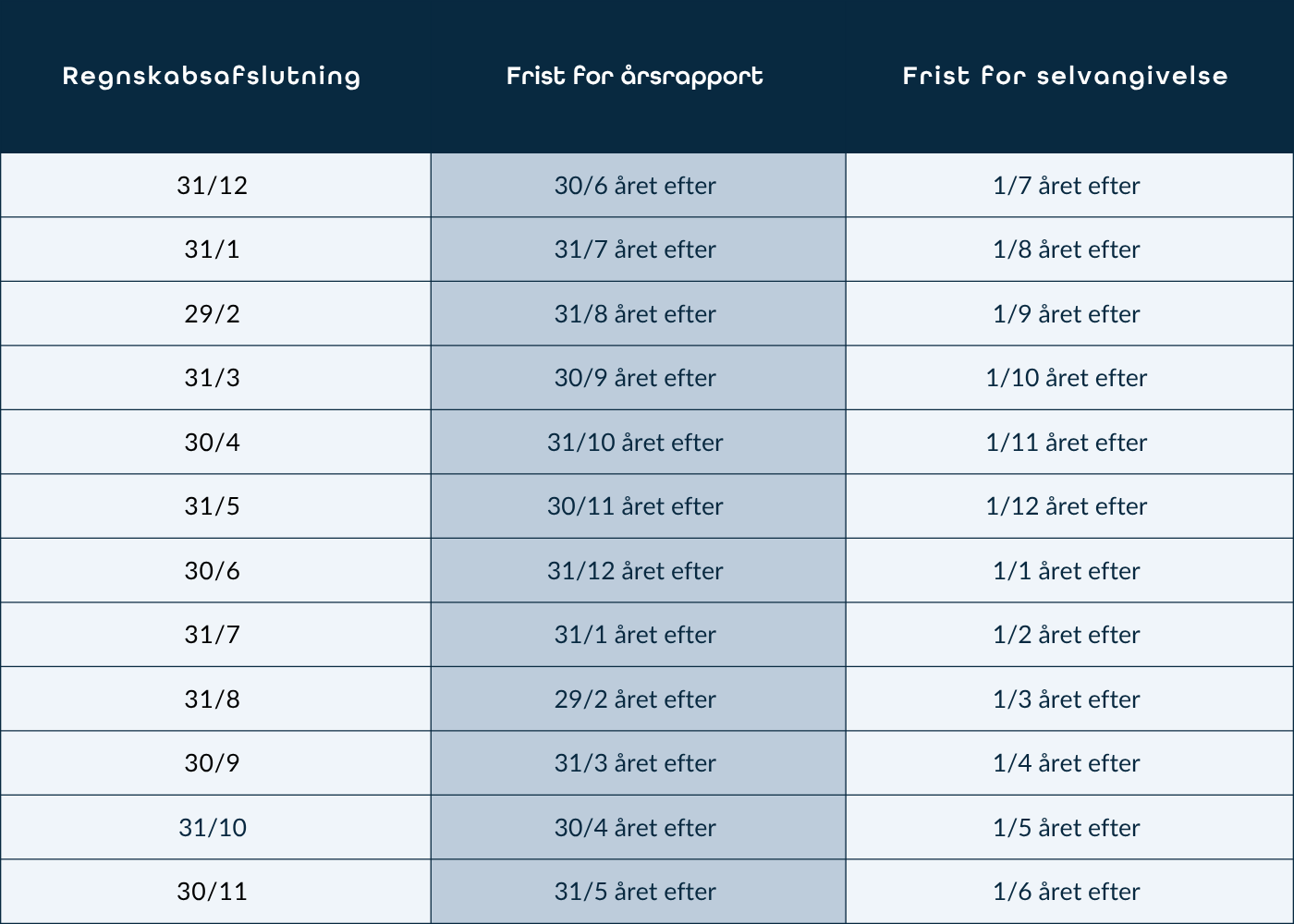

Below you will find a complete overview of annual report deadlines and tax return deadlines for Danish companies.

When should the annual report be submitted?

The deadline for the annual report depends on the company’s financial year. Typically, it’s six months after the end of the financial year, but the date can vary depending on when your financial year ends. It is therefore important to keep an eye on your company’s deadline to avoid fines or deletion from the Danish Business Authority’s register.

When should the tax return be submitted?

The tax return must be submitted one month after the annual report, and this is done directly to the Tax Agency via TastSelv Erhverv. The deadline may vary from company to company, but you can use the form below as a starting point

How Accountview helps you meet deadlines

When you get your annual report from Accountview, we make sure all deadlines are met. We take care of reporting to the relevant authorities and send you an update email so you always know what the next step is. That way, you don’t have to worry and can rest assured that everything will be sent correctly and on time.

If you have any questions about the process or need help submitting your annual report or tax return, we’re here to help.