Mileage allowance 2025

Last updated 26/08/2025 – Reading time: 2 min

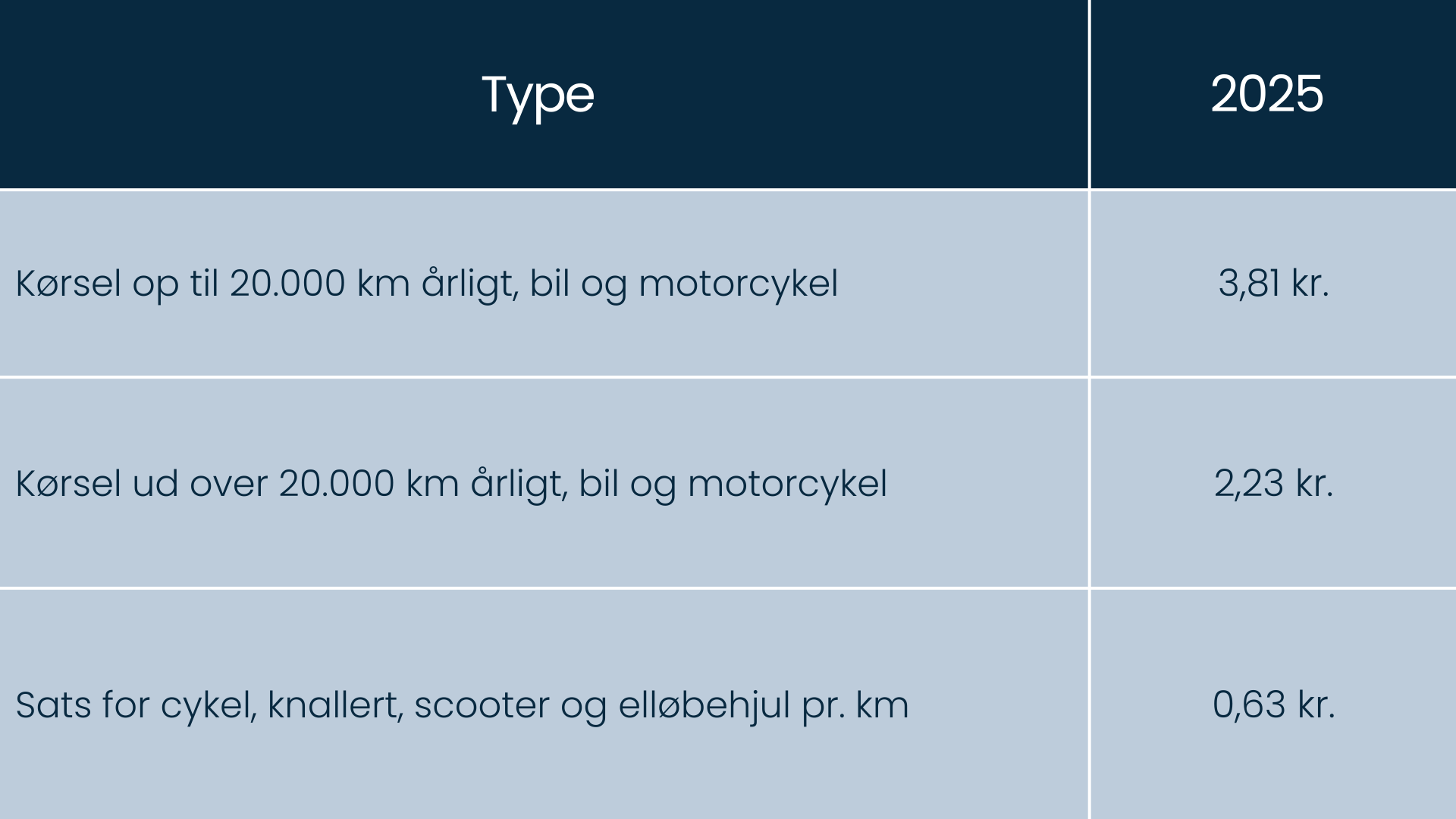

If you make your own car available to the company, you can receive tax-free mileage allowance. The rates for 2025 are set by the Danish Tax Agency and are shown in the table below.

Table of rates for 2025

Rules for tax-free driving

You can’t get tax-free mileage if you are taxed on your free car. As an employee or owner, you are responsible for paying all the running costs of the car, such as fuel, road tax, insurance and maintenance.

The company may only cover parking, bridge tolls and ferry costs when you receive mileage reimbursement.

Documentation and logbook

In order to receive tax-free mileage allowance, you must be able to document your driving with a logbook.

It must contain:

- Date and time

- Kilometers

- Registration number

- Purpose of the drive

- Start and end destination

We recommend using Salary, which has an integrated driving feature that automatically records distance via Google Maps and stores the documentation digitally.

Mileage allowance vs. commuting allowance

Remember that mileage allowance is not the same as transportation deduction. The transportation allowance is given to private individuals in their personal tax return, while mileage reimbursement is payment from the company for business driving.

Get help with correct registration

Not sure how to register driving correctly or how it affects your taxes?

Accountview helps you ensure your mileage reimbursement is handled according to the rules, avoiding errors and extra tax.