Tax-free per diems 2025

Last updated 26/08/2025 – Reading time: 2 min

Tax-free per diems are an allowance that companies can pay to employees to cover the cost of food, lodging and small necessities for business travel. For per diems to be paid tax-free, the trip must last at least 24 hours and be considered a business trip. If these conditions are not met, the allowances are taxed as ordinary salary.

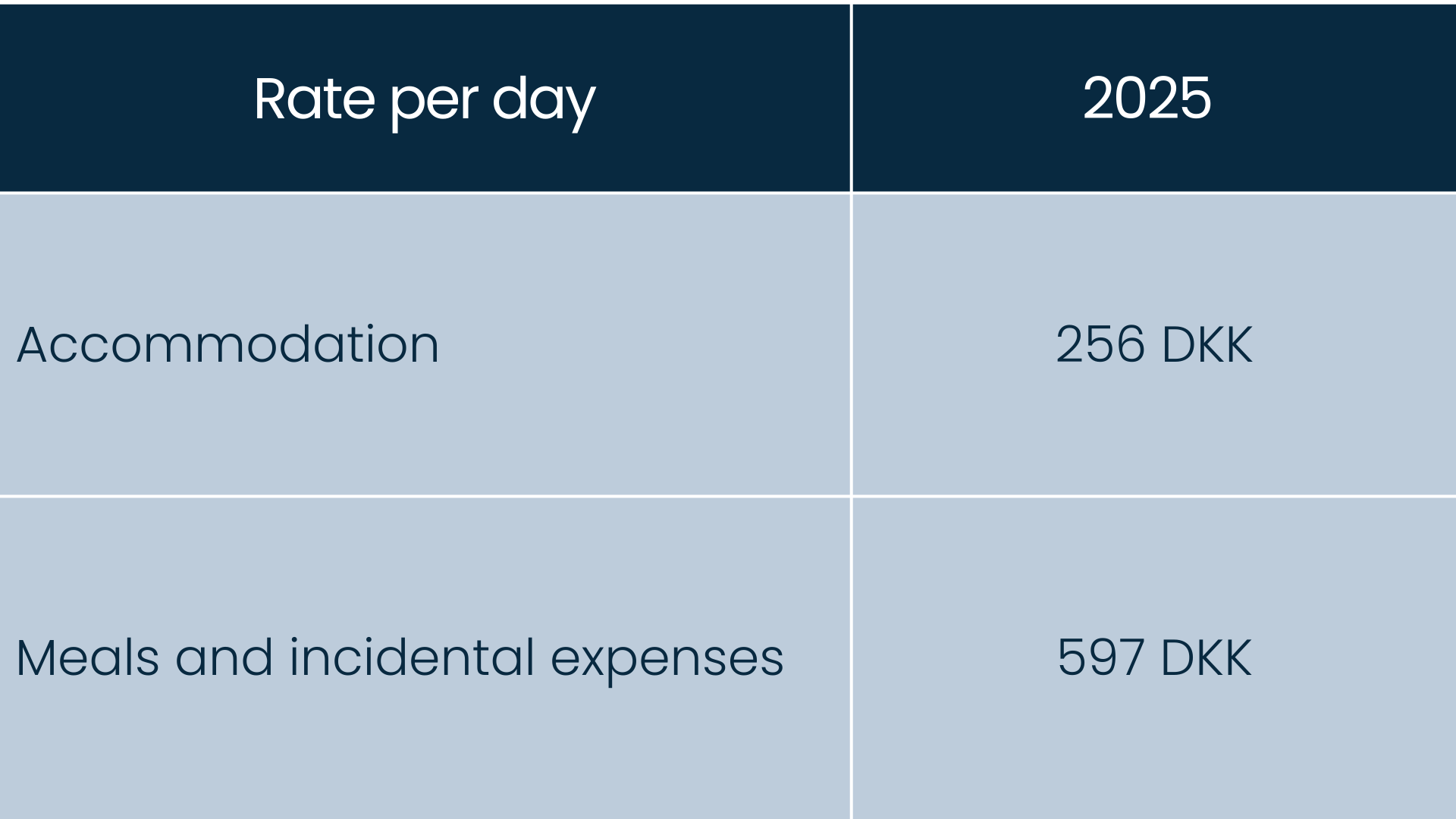

Tax-free diet rates 2025

Who can receive per diems?

There are certain exceptions that you should be aware of:

- Owners of sole proprietorships cannot pay tax-free perks to themselves, but must deduct the value from the company's profit.

- Owners and employees of companies can be paid per diems, but only if actual wages are paid for work performed.

How is the tax-free travel allowance calculated?

Per diems are calculated based on government rates. If the journey lasts more than 24 hours, you will be reimbursed for the entire 24 hours, for shorter journeys the amount is calculated as an hourly allowance based on the same rate.

Remember that correct calculation is important as errors can affect your company’s VAT and tax reporting.

Get help with managing diets

If you are unsure how to calculate or pay out tax-free per diems correctly, we can help you. At Accountview, we make sure that all allowances are handled correctly in your accounts to avoid errors and unnecessary tax costs.