Meals and deductions

Last updated 24/09/2025 – Reading time: 2 min

Catering is one of the expenses that many businesses and self-employed people are often unsure about. When preparing the accounts, it can be unclear when food and drink expenses are deductible.

The basic rule is simple: if the expenses are directly related to work, you may be able to deduct them. However, this doesn’t apply in all situations, and the rules vary depending on whether it’s for employees, customers or private meals.

Rules for meals and deductions for employees

For employees, the company can generally deduct expenses for meals when they are incurred in connection with work. This could be internal meetings, courses or travel. Therefore, these expenses are fully deductible.

Meals and deductions for customers and business partners

When it comes to customers and business partners, however, the rules are stricter. As a rule, only 25% of expenses are deductible. This applies, for example, to customer meetings, networking events or other business events.

No deductions for private meals

Private meals are never tax deductible. This means you can’t deduct your own lunch or dinner, even if you work from home.

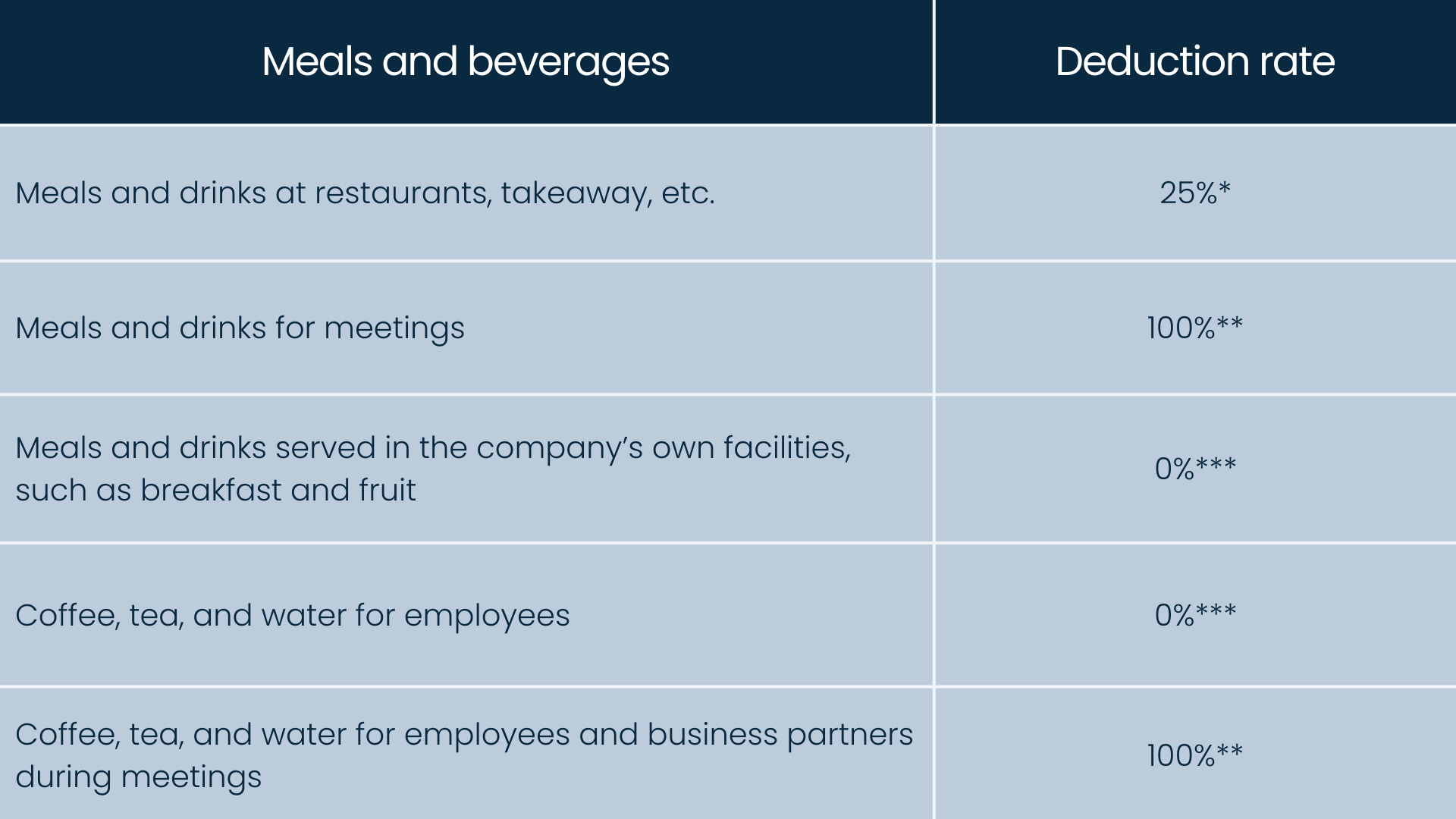

Quick overview of the rules

*In Dinero, Billy and E-conomic, it is possible to select representation VAT if the deduction rate is only 25%.

**If there is a 100% deduction rate, regular purchase VAT is selected on the entry.

*** If there is a 0% deduction rate, the VAT heading must be blank

Remember the documentation

It’s important to save receipts and document what the expenses for meals cover, as the Tax Agency often looks at this area during inspections.

Do you need help?

At Accountview, we help businesses navigate hospitality regulations to avoid mistakes and make the most of your deductions. We ensure that your expenses are accounted for correctly and that your business complies with current legislation.

Contact us here for a free, no-obligation chat about how we can help your business correctly handle catering, deductions and other tax issues.