Partial VAT Deduction

Last updated 26/08/2025 – Reading time: 2 min

Partial VAT is an important part of VAT accounting for businesses that have both VAT-taxable and VAT-exempt activities. When using this method, businesses can deduct a percentage of VAT on their expenses. Correct calculation is essential to avoid errors in accounting and to ensure your business is compliant.

Types of VAT deductions for partial VAT

When a business is registered for VAT, the deductibility depends on the type of expense:

- 100% VAT deduction for the taxable part of the company's activities.

- 0% VAT deduction for the VAT-free part of the company's activities.

- Partial VAT deduction (partial VAT) for expenses related to both VATable and VAT-exempt activities.

How to calculate it

The deduction rate is calculated according to this formula:

(Taxable turnover / Total turnover) × 100

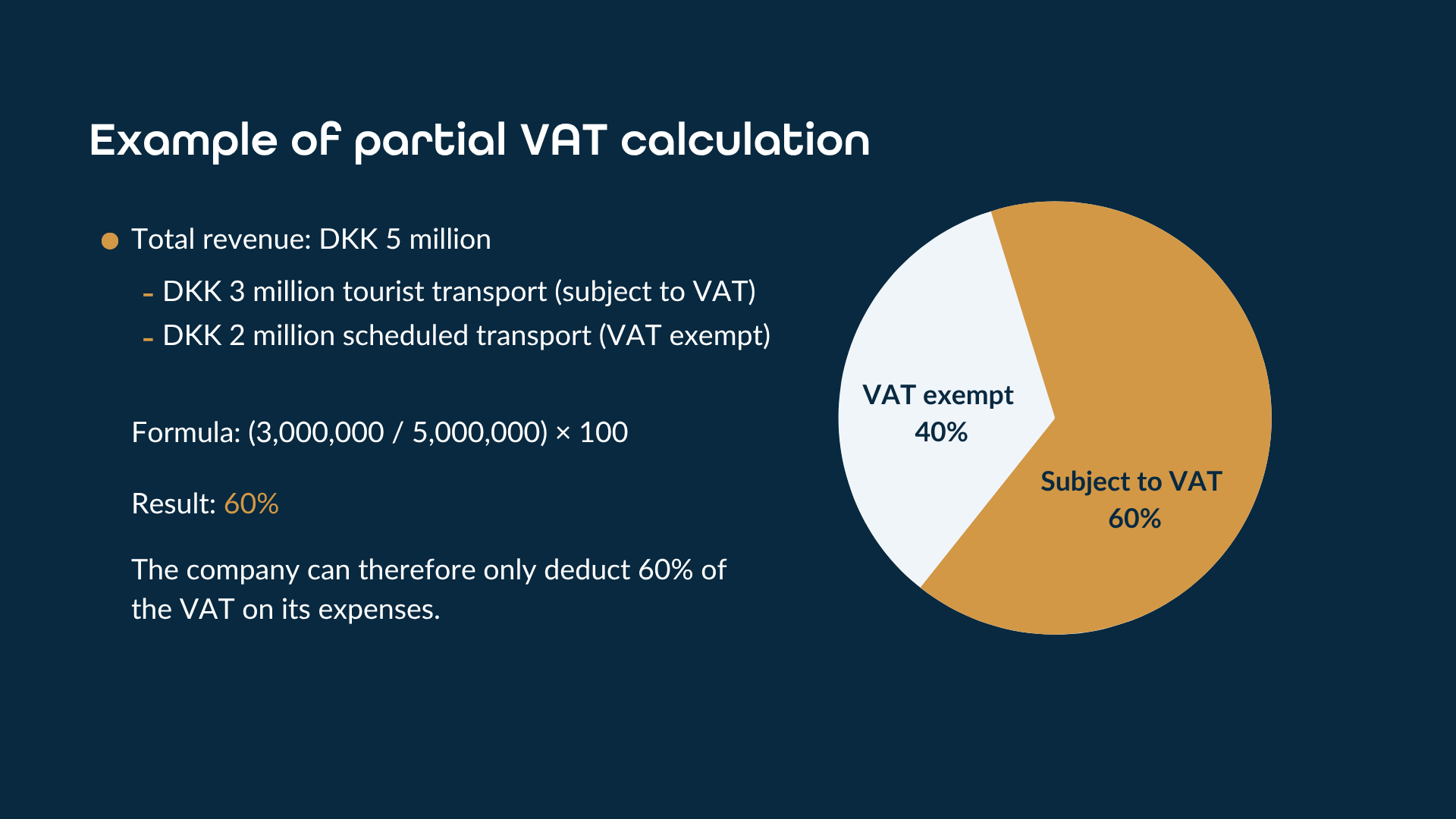

An example could be a bus company with an annual turnover of DKK 5 million.

- DKK 3 million comes from tourist traffic (subject to VAT).

- 2 million comes from scheduled services (VAT-free).

Formula: (3,000,000 ÷ 5,000,000) × 100 = 60%.

Therefore, the company can only deduct 60% of the VAT on its expenses.

Good advice on partial VAT

The company must use the same deduction rate throughout the year. Once the financial year is complete, the exact deduction percentage is calculated and used in the following year. It is recommended to make a conservative calculation during the year to avoid having to adjust too much later.

A handy tip is to gather all documents related to VAT deductions in a separate folder. This makes it easier to document to the Tax Agency if the company needs to present calculations.

You can read more about the rules for partial VAT here.

We can help you

If your business has both VAT-exempt and VAT-liable activities, the rules for partial VAT can quickly become complex. At Accountview, we have VAT experts who can help you calculate and report correctly to avoid errors.