Conversion from personally run business to limited liability company

What do you need to know?

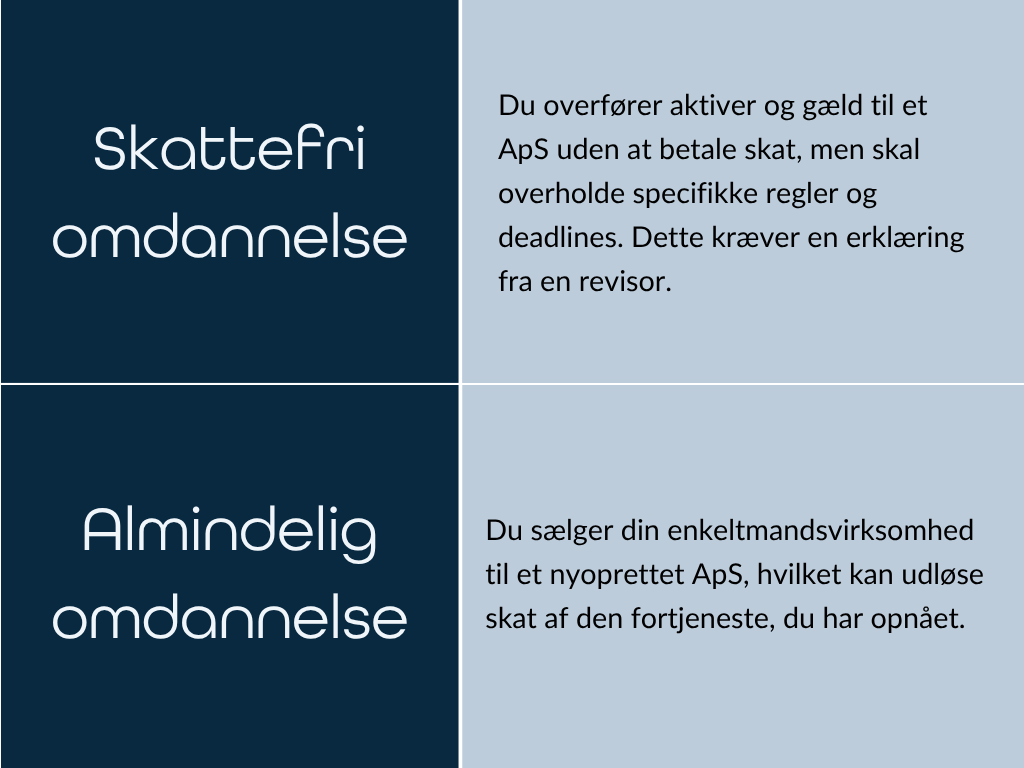

If you run a personally run business (sole proprietorship, partnership or freelance) and want to convert to a limited liability company, there are several requirements you need to meet before it can be realized through a tax-free conversion.

- The capital must be a minimum of 40,000 DKK

- Your creditors must accept the conversion

- An auditor's statement with assurance must be prepared

You cannot close your sole proprietorship and open a company where you continue the same activities. If the you do soyou will be taxed on the valuethat is builtbuilt up in the personally drivenne Company. S KAT has established a calculation model for this.

Common reasons to make a conversion

- No personal liability

- More flexibility when it comes to paying taxes

- Possibility of multiple owners with different ownership stakes

A tax-free conversion can be an advantageous solution, but it is important to meet the necessary requirements. If you would like advice on the process, we are ready to guide you through the necessary steps.