Which business form should I choose?

It's important to choose the right business type from the start. Here's a simple overview of the most common types and what's best for you and your situation.

Choose the right business form

There are several business forms in Denmark, and it’s important to choose the right one from the start.

At Accountview, we help sole traders, partnerships, limited liability companies and limited companies, and we’re happy to guide you if you’re unsure what best suits your needs.

Sole proprietorship

- No capital requirements

- One owner who is personally liable

- Easy to start, but you risk your personal finances

Partnership

- No capital requirements

- Multiple owners jointly and severally liable

- Requires collaboration and trust

Private limited company

- Requirement of 20,000 kr. capital

- Limited liability

- Suitable for growth and flexible ownership

Public limited company

- Requirement for 400,000 kr. capital

- Requirements for board of directors

- Primarily used in larger companies

Choose the right business form

There are several business forms in Denmark, and it’s important to choose the right one from the start.

At Accountview, we help sole traders, partnerships, limited liability companies and limited companies, and we’re happy to guide you if you’re unsure what best suits your needs.

Sole proprietorship

- No capital requirements

- One owner who is personally liable

- Easy to start, but you risk your personal finances

Partnership

- No capital requirements

- Multiple owners jointly and severally liable

- Requires collaboration and trust

Private limited company

- Requirement of 20,000 kr. capital

- Limited liability

- Suitable for growth and flexible ownership

Public limited company

- Requirement for 400,000 kr. capital

- Requirements for board of directors

- Primarily used in larger companies

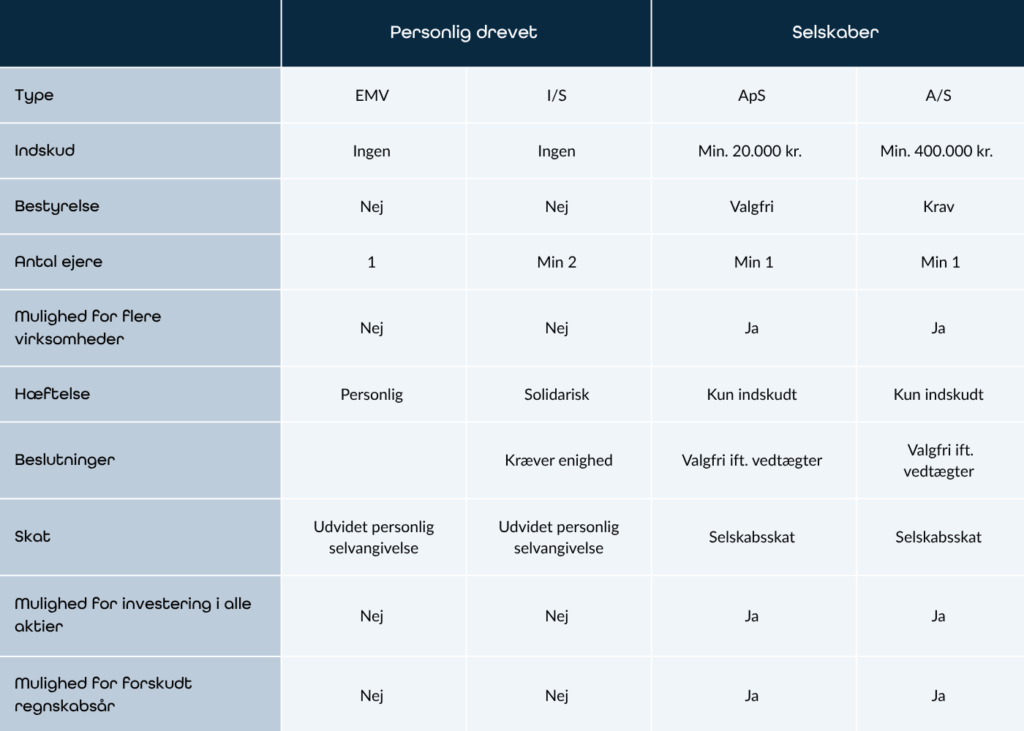

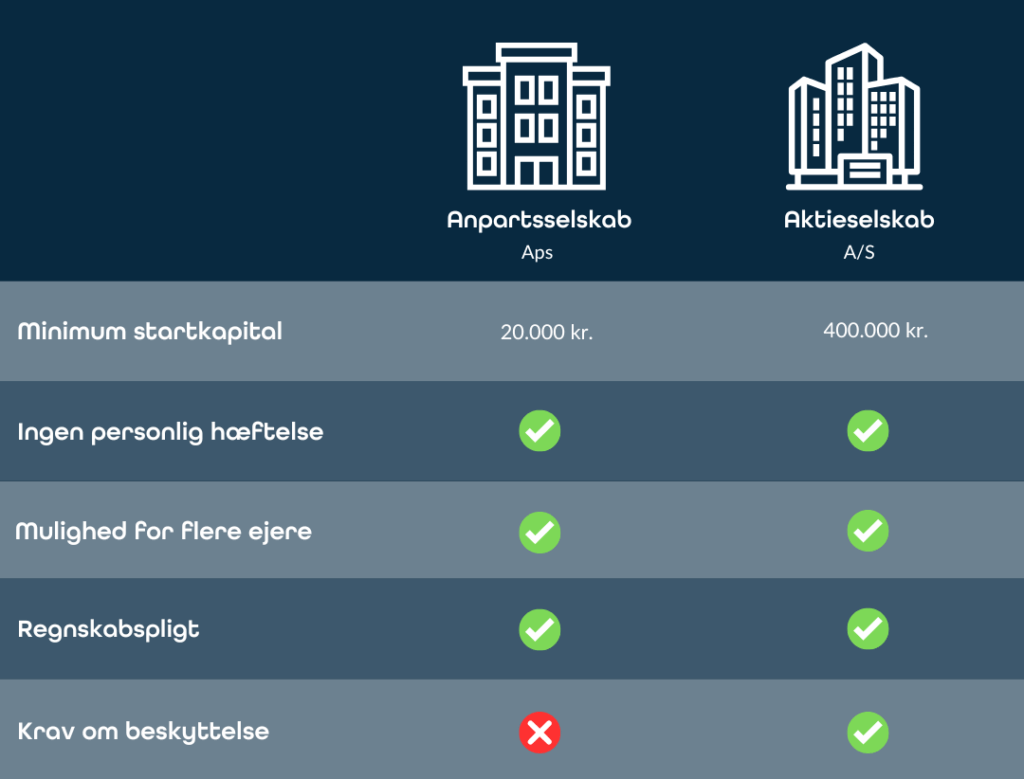

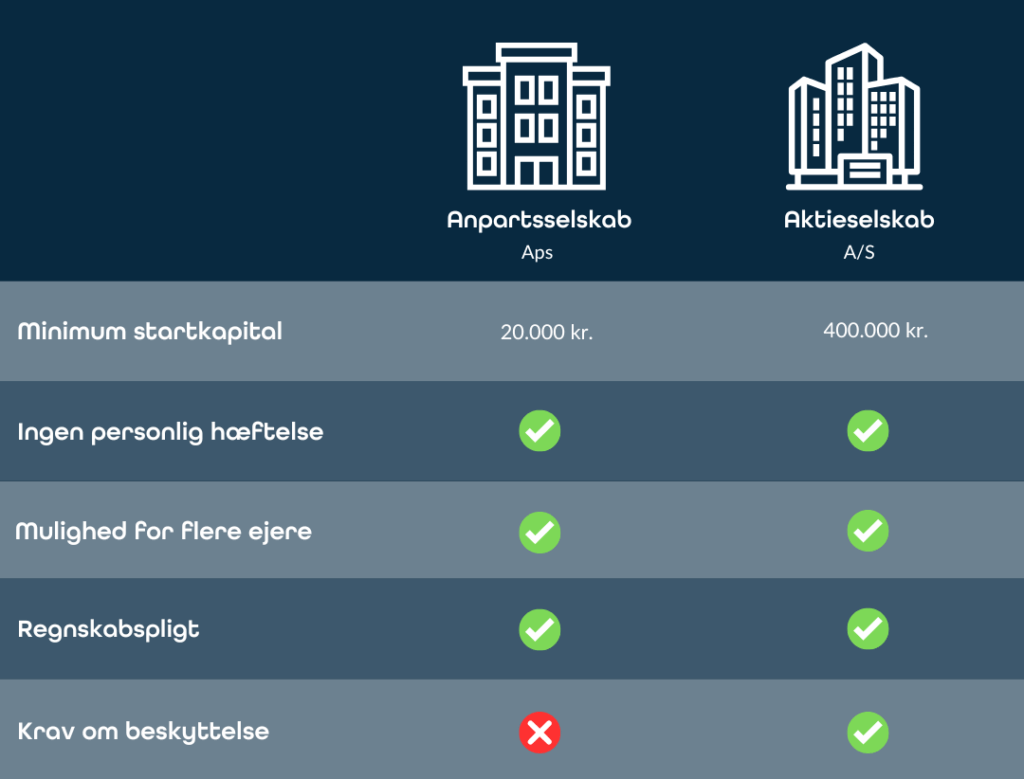

Compare the most common business types

There are differences in how different types of businesses work. This table gives you a quick overview to help you decide what’s right for you and your situation.

Still in doubt? We’re happy to help you make the right choice from the start.

Compare the most common business types

There are differences in how different types of businesses work. This table gives you a quick overview to help you decide what’s right for you and your situation.

Still in doubt? We’re happy to help you make the right choice from the start.

Frequently asked questions about business forms

It can be difficult to figure out which form of business best suits your situation, especially as a startup or if you want to switch.

Here we’ve gathered the most common questions we get from customers faced with that choice.

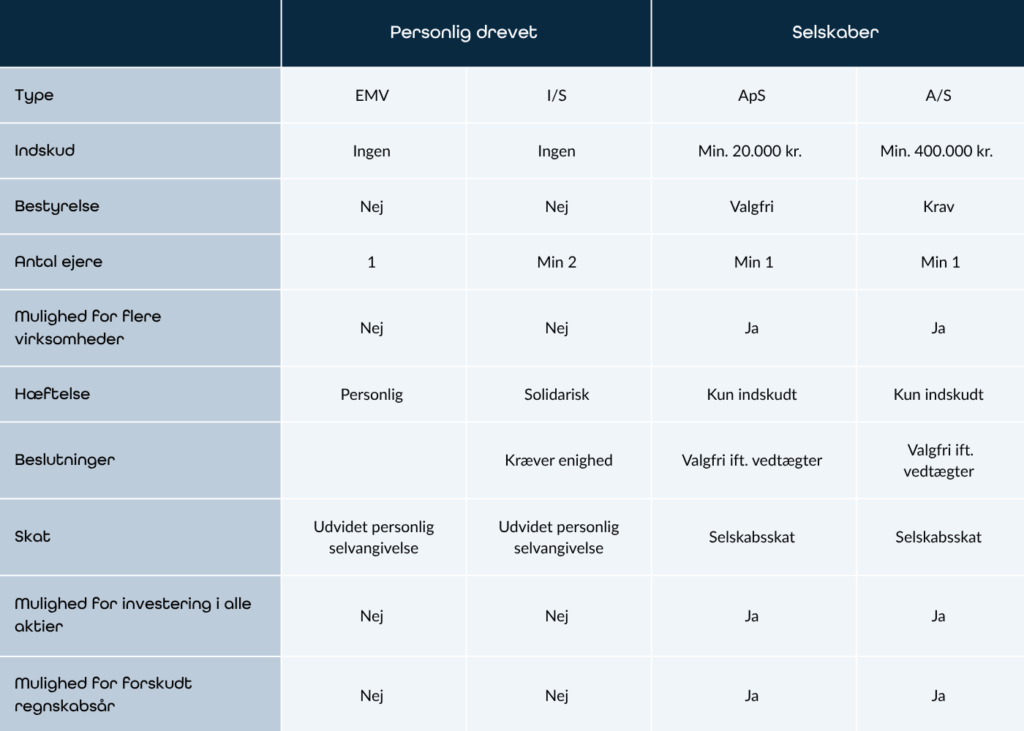

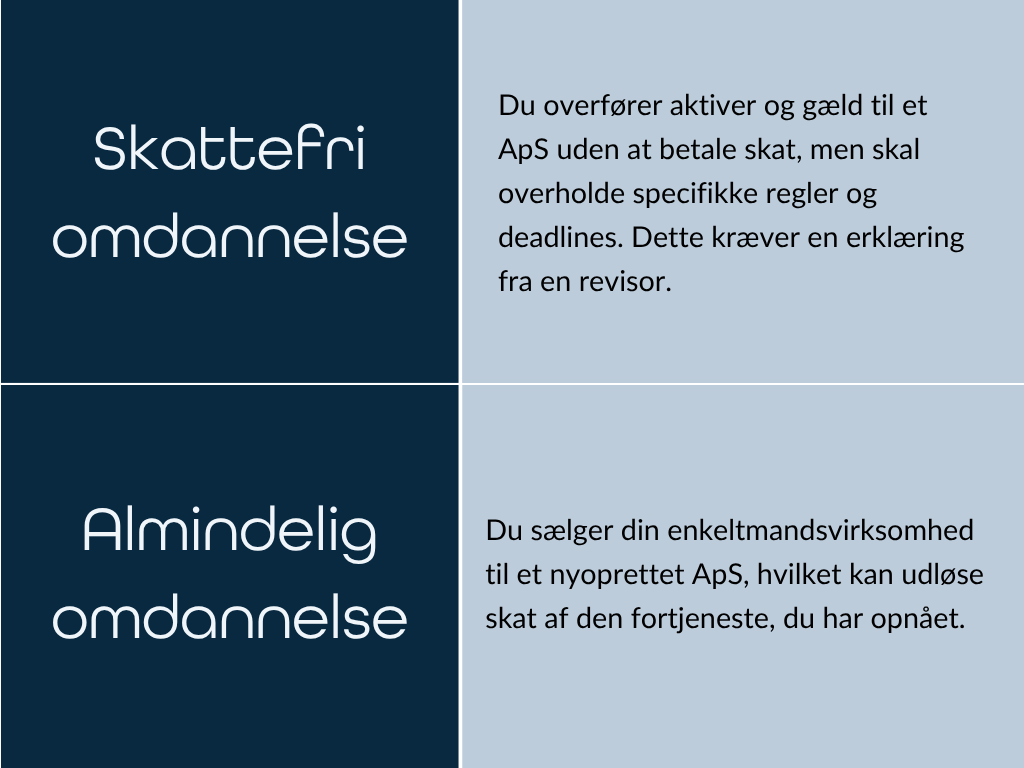

Can I start as a sole trader and switch to ApS later?

There are two ways to convert your sole proprietorship into an ApS:

For both solutions, an auditor’s declaration is required.

If you close a sole proprietorship and start a company without a declaration, you risk being taxed privately, often on at least DKK 250,000.

Am I personally liable in an ApS?

No, you are not. In an ApS, you are only liable with the contributed capital (min. DKK 20,000). Your personal finances are generally protected.

Do I need a board of directors in my company?

Only if you choose an A/S. An ApS does not require a board of directors – it is optional and decided in the articles of association.

How quickly can I set up a business?

A sole proprietorship can often be set up the same day via virk.dk. A private limited company typically takes 1-3 business days to set up. If everything is filled out correctly, you can often get your CVR number the same day.

Want to start your company today?

Is an auditor required in an ApS?

As a general rule, you don’t need an accountant unless your business is subject to mandatory auditing.

You can opt out of auditing if your company does not exceed two of the following three thresholds:

- A balance sheet total of over 4 million DKK.

- A net revenue over 8 million DKK.

- Average of 12 full-time employees during the financial year

Although not a requirement, it can still be beneficial to use an accountant, for example to ensure correct accounting and optimize finances.

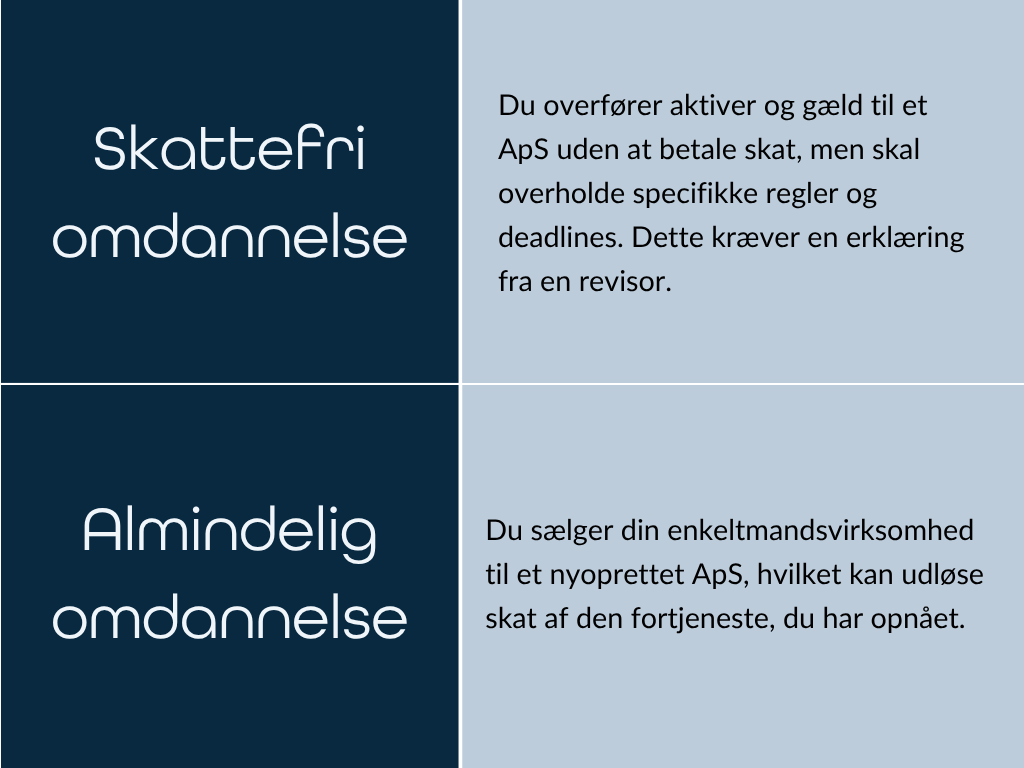

What is the main difference between ApS and A/S?

The table gives you an overview of the main differences between a private limited company and a public limited company.

Is it possible to run multiple businesses simultaneously as an EMV?

No, you can’t. Sole proprietorships are linked to your social security number and can only accommodate one business. If you want more, you should consider setting up a company.

Frequently asked questions about business forms

It can be difficult to figure out which form of business best suits your situation, especially as a startup or if you want to switch.

Here we’ve gathered the most common questions we get from customers faced with that choice.

Can I start as a sole trader and switch to ApS later?

There are two ways to convert your sole proprietorship into an ApS:

For both solutions, an auditor’s declaration is required.

If you close a sole proprietorship and start a company without a declaration, you risk being taxed privately, often on at least DKK 250,000.

Am I personally liable in an ApS?

No, you are not. In an ApS, you are only liable with the contributed capital (min. DKK 20,000). Your personal finances are generally protected.

Do I need a board of directors in my company?

Only if you choose an A/S. An ApS does not require a board of directors – it is optional and decided in the articles of association.

How quickly can I set up a business?

A sole proprietorship can often be set up the same day via virk.dk. A private limited company typically takes 1-3 business days to set up. If everything is filled out correctly, you can often get your CVR number the same day.

Want to start your company today?

Is an auditor required in an ApS?

As a general rule, you don’t need an accountant unless your business is subject to mandatory auditing.

You can opt out of auditing if your company does not exceed two of the following three thresholds:

- A balance sheet total of over 4 million DKK.

- A net revenue over 8 million DKK.

- Average of 12 full-time employees during the financial year

Although not a requirement, it can still be beneficial to use an accountant, for example to ensure correct accounting and optimize finances.

What is the main difference between A/S and ApS?

The table gives you an overview of the main differences between a limited liability company and a private limited company.

Is it possible to run multiple businesses simultaneously as an EMV?

No, you can’t. Sole proprietorships are linked to your social security number and can only accommodate one business. If you want more, you should consider setting up a company.